Why You Need a Will, Even If You’re Not a Prince

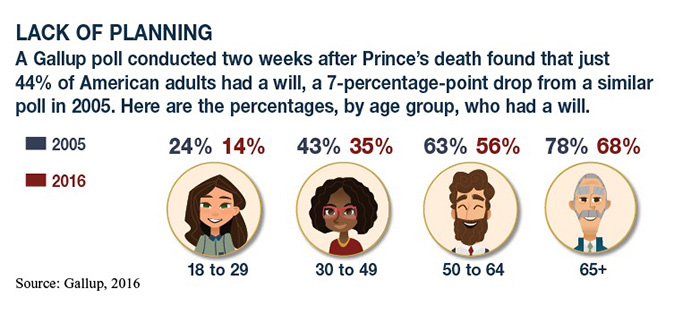

The unexpected death of famed musician Prince in April 2016 put the importance of a will in the national spotlight. Prince, who apparently died intestate, without a legal will, left an estate worth an estimated $150 million – $300 million. Those assets’ disposition will now be up to the state of Minnesota and may take many years to be resolved (1).

Expressing Your Wishes

Regardless of your estate’s value, a will can help ensure that your assets are distributed according to your wishes. It enables you to name an executor for your estate. It can be an effective way to designate a guardian for minor children. If you die without a valid will, the state could decide how your assets are distributed.

Typically, assets go to the surviving spouse and children, but state laws and distribution formulas vary widely. When the deceased dies intestate and leaves no spouse or children, the situation becomes more complicated, as was Prince’s case. Having a will does not avoid probate, the legal process by which assets are distributed. However, a will could make probate more efficient and less expensive.

Personal Property

You can bequeath tangible assets such as jewelry or works of art in a will, but it may be more convenient to list whom you want to receive specific assets in a personal property memorandum. This is not a legal document, so it does not have to be witnessed or notarized and easily changed.

You can make the memorandum a legal document in most states by referring to it in your will. Even if your state does not consider it legally binding, your heirs will have a clear indication of your intentions. You cannot use a memorandum to bequeath real estate or intangible property such as money, bank accounts, securities, and copyrights.

Advance Preparation

Preparing a legal will does not have to be time-consuming or expensive, but you should consider consulting an estate planning professional familiar with the laws of your state. Be sure to tell your executor and beneficiaries where to find the signed copy of your will and other legal documents. Don’t forget to update your will when major life events occur, such as a change in marital status, the birth of children or grandchildren, the purchase or sale of a home or other significant assets, and when tax laws change.

1) Forbes, April 27, 2016

The information in this article is not intended as tax or legal advice. It may not be relied on to avoid any federal tax penalties. You are encouraged to seek tax or legal advice from an independent professional advisor.

The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for any security purchase or sale. This material was written and prepared by Emerald. Copyright 2016 Emerald Connect, LLC.